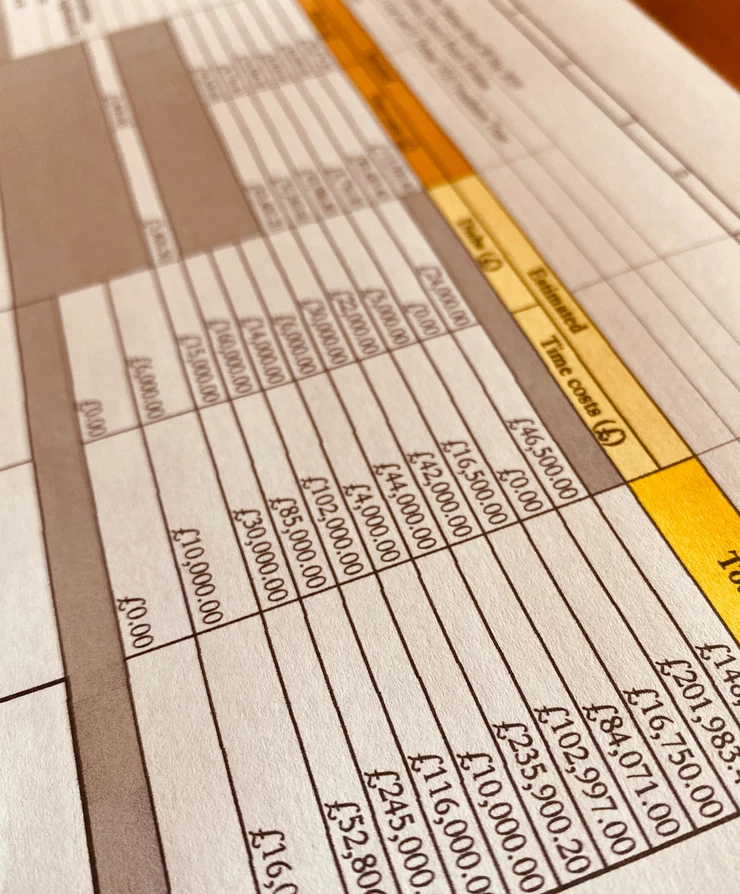

How did we reduce the Claimant’s Bill of Costs in a litigation matter by 48% in 60 days?

We utilised our knowledge of technical and evolving areas of legal costs and advanced all possible arguments to dispute the costs claimed. This coupled with our tenacious approach to the costs negotiations, enabled us to reach a swift and successful settlement of costs.

Whilst our law costs draftsman team are experts in drafting Bills of Costs and recovering legal costs, we are also specialists in opposing legal costs and we obtain significant reductions when instructed on behalf of our paying party clients.

More often than not, costs are assessed on the standard basis, meaning that any doubt which the Court may have as to whether costs were reasonably and proportionately incurred, or were reasonable and proportionate in amount, will be resolved in favour of the paying party.

It is therefore imperative that proper consideration is given to the full extent of the nature and range of objections that could be advanced to minimise the paying party’s liability for costs.

Our law costs draftsman team have compiled a list of 10 tips (in no particular order) that can help to ensure that any paying party will only pay reasonable and proportionate costs.

1. Consider the funding position

Costs will only be payable inter-partes if there is a valid retainer in place. Where there is no valid retainer between the solicitor and client, there is no entitlement to charge.

Where there is a genuine concern over a receiving party’s funding arrangement, the paying party should set out in writing any further information it seeks in relation to the validity of the arrangement, without making it a fishing expedition.

Consideration should be given to cases in which there was an assignment of a CFA, a switch from legal aid to CFA, or where there are concerns that the scope of a legal aid funding certificate may not cover the work undertaken.

2. Check the orders carefully

It is important to review all orders made during the proceedings to ascertain whether the costs of any applications or other discrete aspects of the claim have been wrongly included within the Bill of Costs.

Costs will not be payable for any part of the claim in which there was ‘no order as to costs’, where the paying party was successful in an application that was followed by an order stating ‘costs in the application’, where the paying party has set aside an application or order that was followed by an order stating ‘costs thrown away’, or potentially where an order is silent as to costs.

For more information on the different types of costs orders and their meaning, check out our blog: Costs Orders Available to the Court: Ensuring the Correct Order is Obtained

3. Have regard to all factors under CPR 44.3(5) when considering proportionality

Paying parties often place too much emphasis on simply the sums in issue when considering proportionality and fail to have regard to the other factors under CPR 44.3(5). What else should be taken into account?

If there was no non-monetary relief in the proceedings and no wider factors involved in the proceedings such as public importance, this should be highlighted. Any aspects of the proceedings that were particularly straightforward in nature should be set out. Finally, if the conduct of the paying party was reasonable and helped the Court in furthering the overriding objective, details of this reasonable conduct should be highlighted.

4. Consider whether there is good reason to depart from any approved costs budget

In any case where a costs management order has been made, when assessing costs on the standard basis, the Court will not depart from the approved budgeted costs unless satisfied that there is good reason to do so.

In such cases, consideration should be given to whether there is good reason to depart downwards from the approved costs budget. There is currently little authority on what constitutes good reason, but this in itself presents opportunities. Whatever argument is advanced, it is important that it is based on the specific facts of the individual case.

Fairly often in proceedings, not every phase of the costs budget is substantially completed. This is considered by the Courts to be a good reason to depart and so paying parties can often reduce the costs claimed. We cover this subject in more detail in our blog Underspend or Incomplete Costs Budget Phase: A Clear Distinction Should be Made.

If this approach is adopted, it is important that consideration is given to the assumptions within the costs budget, as these will set out what work was anticipated by the receiving party. The Bill of Costs can then be used to establish what work was actually undertaken.

5. Consider the level of delegation when assessing hourly rates

Pursuant to the overriding objective at CPR 1.1, the parties have a duty to help enable the Court to deal with cases justly and at proportionate cost. An important part of this duty includes saving expense.

Where possible, legal teams should save expense by delegating routine work to more junior fee earners. Often, tasks such as arranging conferences, obtaining witness statements, preparing first document drafts and researching novel legal issues are capable of delegation in order to reduce costs.

Where a receiving party has failed to delegate such tasks and there is a clear imbalance between time spent by a Partner / Grade A and a Trainee / Grade D, the receiving party may have failed to mitigate costs. This may be reasonable grounds for reducing the hourly rate in its entirety or, alternatively, reducing the costs of the work that was capable of delegation to a Trainee / Grade D hourly rate.

6. Be wary of changes in fee earners and counsel

Occasionally at some point during a legal matter, there is a change in conducting fee earner or counsel. This may be due to a fee earner leaving the firm, the present counsel being occupied on a different matter or some other reason.

Why should attention be paid to changes in fee earners and counsel? A change in fee earner or counsel often generates additional costs of reading in and familiarising with the case, and it can be argued that such costs should not be borne by the paying party, particularly where costs are assessed on the standard basis and any doubt as to whether costs were reasonably and proportionately incurred will be resolved in favour of the paying party.

7. Object to interest if there has been a delay in commencing detailed assessment proceedings

Interest on costs run from the date of the judgment, order or other determination giving right to the assessment of costs. Under CPR 47.7, the period for commencing detailed assessment proceedings is three months after the date of the judgment or order. If the receiving party fails to commence proceedings within this time, it is important to challenge the receiving party’s entitlement to all or part of interest otherwise payable under section 17 of the Judgments Act 1838 or section 74 of the County Courts Act 1984.

8. Punish poorly drafted Bills of Costs

Where the Bill of Costs wrongly includes costs, has made the assessment of costs unnecessarily difficult, or is poorly drafted in some other way, the costs of preparing and checking the Bill of Costs should be disputed.

Additionally, whilst the Master of the Rolls 2014 decision on the Civil Justice Council’s report on guideline hourly rates recommended that costs lawyers be eligible for payment at Grade B and C hourly rates, this was subject to the complexity of the work undertaken. We regularly see a law costs draftsman claiming hourly rates of £160 and above to prepare straightforward Bills of Costs. If the work involved in preparing the Bill of Costs is not complex, a Grade D hourly rate may be more appropriate.

9. Get the Points of Dispute right

The costs pleadings placed before the Court provide the foundations for achieving a successful outcome at detailed and provisional assessment.

It is important that the Points of Dispute achieve the right balance between being “short and to the point”, as required under Practice Direction 47, and being drafted in a way that ensures they are persuasive and enable the parties and Court to determine precisely what is in dispute and why.

Also, avoid the use of template paragraphs. Points of Dispute are more credible when they are bespoke and the law cost draftsman has demonstrated that thought has been given to the facts of an individual matter.

10. Put forward a reasonable offer of settlement early on where appropriate

When instructed on behalf of paying parties, we are conscious that, pursuant to CPR 47.20, the receiving party will generally be entitled to the costs of the detailed assessment proceedings. Our law cost draftsman team aim to reduce our client’s liability for costs of assessment, and we do this by putting forward a reasonable offer of settlement before the receiving party incurs a large amount of costs of assessment, for example the costs of preparing Points of Reply.

Conclusion

These are just some of the factors that help us to oppose unreasonable claims for costs. To ensure that the necessary reductions are obtained, careful consideration should firstly be given to matters of principle, which are likely to concern and effect significant proportions of the costs, before individual items are identified and challenged.

When instructed on behalf of paying parties, we ensure that our clients are provided with pragmatic advice in relation to the strengths and weaknesses of their position, as well as the realistic level of costs that would be awarded at assessment so that they can make decisions with the best possible information and advice to hand.

If you require a law costs draftsman to help reduce a Bill of Costs to ensure that only reasonable and proportionate costs are paid, contact us today on info@athenelegal.co.uk or 020 7459 4843.